Homeowners Insurance in and around Crown Point

If walls could talk, Crown Point, they would tell you to get State Farm's homeowners insurance.

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

- Schererville, IN

- Merrillville, IN

- St John, IN

- Indianapolis, IN

- Chicago, IL

- Munster, IN

- Valparaiso, IN

- Hammond, IN

- Dyer, IN

- South Bend, IN

- Palatine, IL

- Naperville, IL

- Arlington Heights,IL

- Lansing, IL

- Calumet City, IL

- Cedar Lake, IN

- Highland, IN

- Griffith, IN

- Hobart, IN

- Evansville, IN

- Demotte, IN

There’s No Place Like Home

None of us can see what we will encounter in the future. That’s why it makes good sense to plan for the unexpected with a State Farm homeowners policy. Home insurance is necessary for many reasons. It protects both your home and your precious belongings. In case of a burglary or a tornado, you could have damage to some of your possessions in addition to damage to the structure itself. Without adequate coverage, you may struggle to replace all of the things you lost. Some of the things you own can be protected from theft or loss outside of your home, like if your car is stolen with your computer inside it or your bicycle is stolen from work.

If walls could talk, Crown Point, they would tell you to get State Farm's homeowners insurance.

Give your home an extra layer of protection with State Farm home insurance.

Why Homeowners In Crown Point Choose State Farm

If you're worried about handling the unexpected or just want to be prepared, State Farm's excellent coverage is right for you. Creating a policy that works for you is not the only aspect that agent Aaron Pinkus can help you with. Aaron Pinkus is also equipped to assist you in filing a claim if something does happen.

Now that you're convinced that State Farm homeowners insurance should be your next move, contact Aaron Pinkus today to explore your particular options!

Have More Questions About Homeowners Insurance?

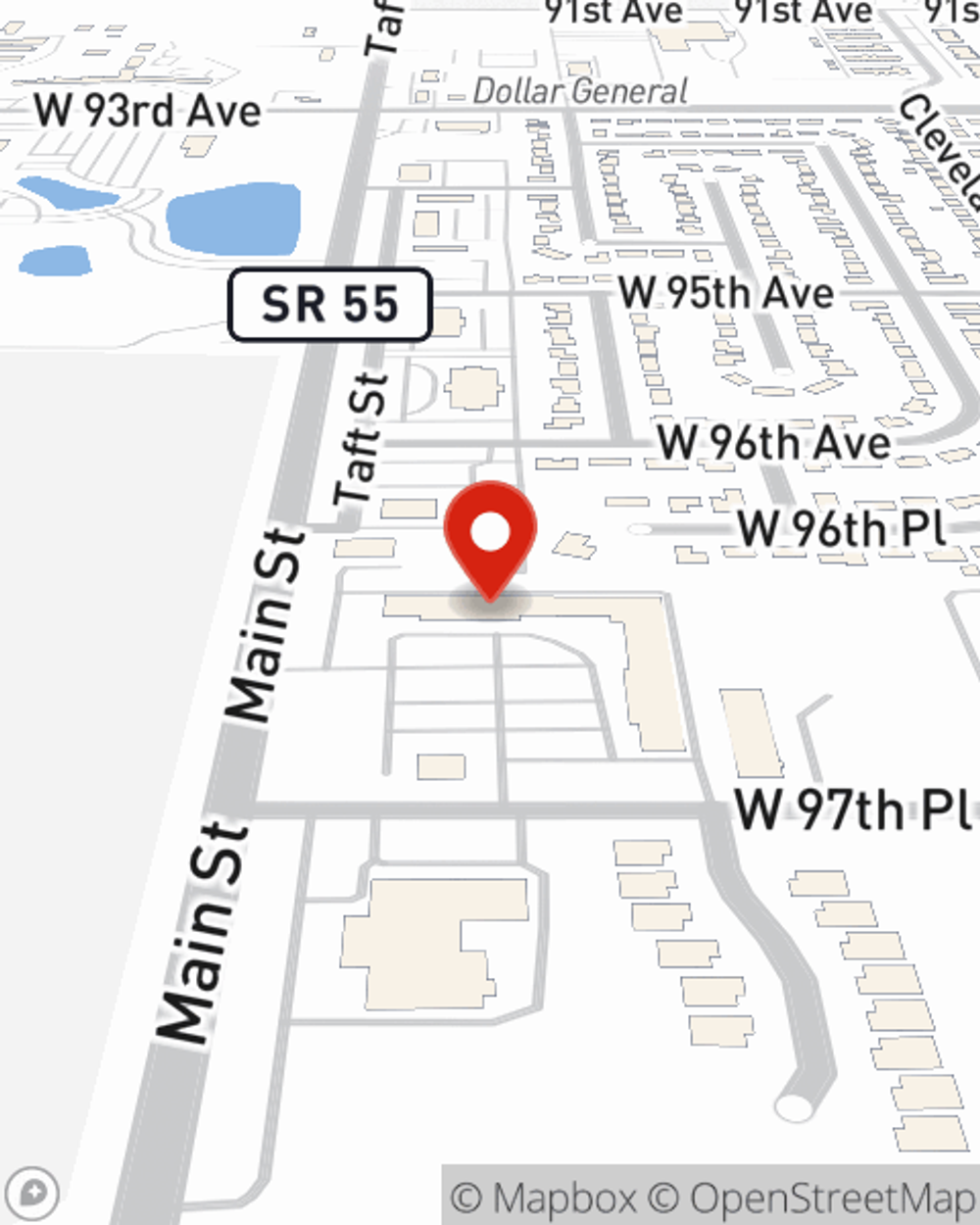

Call Aaron at (219) 663-9000 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

Be aware of electrical hazards in your home

Be aware of electrical hazards in your home

Electricity presents a real danger and can cause extensive damage to your property. Consider these electrical safety tips for your home.

Aaron Pinkus

State Farm® Insurance AgentSimple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

Be aware of electrical hazards in your home

Be aware of electrical hazards in your home

Electricity presents a real danger and can cause extensive damage to your property. Consider these electrical safety tips for your home.